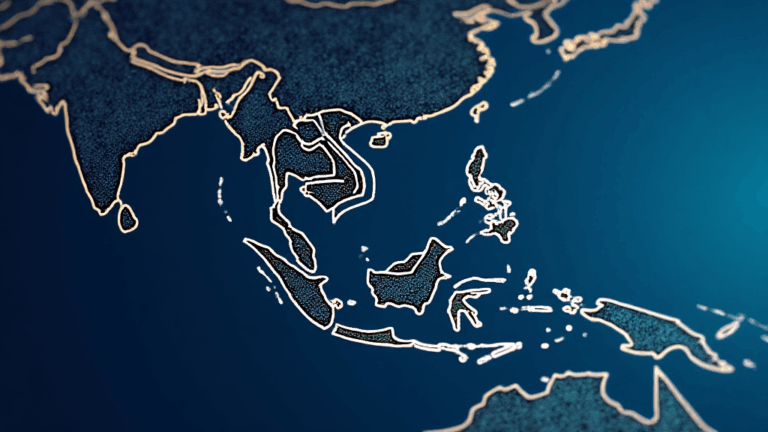

Southeast Asia Digital Asset Regulations: Navigating the Future of Crypto Compliance

With a staggering

Understanding Southeast Asia’s Regulatory Climate

Southeast Asia is witnessing remarkable growth in the digital asset sector. According to a report by Chainalysis, the region saw a

Here’s a snapshot of the regulatory stance in key Southeast Asian countries:

ong>Singapore: ong> Known for its clear regulatory framework, the Monetary Authority of Singapore (MAS) regulates cryptocurrency exchanges under the Payment Services Act.ong>Thailand: ong> The Thai Securities and Exchange Commission oversees cryptocurrency and initial coin offerings (ICOs), enhancing investor protection.ong>Indonesia: ong> The country is developing regulations while balancing innovation with consumer protection, as seen in its recent ban on Bitcoin as a mode of payment.ong>Vietnam: ong> Though legal recognition is still pending, the Vietnamese government is actively seeking to draft regulations for cryptocurrencies. The phrase “tiêu chuẩn an ninh blockchain” (blockchain security standards) is becoming more relevant.

Challenges and Opportunities Ahead

As the digital asset market continues to evolve, so do the challenges associated with compliance. Here are some key issues:

ong>Regulatory Uncertainty: ong> The lack of a harmonized approach across/”>cross the region creates challenges for businesses operating in multiple countries.ong>Consumer Safety: ong> Ensuring investor protection amidst a surge in scams and fraud is paramount.ong>Market Volatility: ong> The inherent volatility of cryptocurrencies poses risks for both investors and the overall economy.

Despite these challenges, opportunities abound. With proper regulation, Southeast Asia could lead the world in crypto innovation, attracting investments and fostering a new wave of technology-driven economic growth.

Regulatory Frameworks and Compliance Norms

Let’s break down the existing regulations and compliance norms within the region. Navigating

| Country | Regulatory Authority | Key Regulations |

|---|---|---|

| Singapore | Monetary Authority of Singapore (MAS) | Payment Services Act |

| Thailand | Thai Securities and Exchange Commission | Securities and Exchange Act, Anti-Money Laundering Act |

| Indonesia | Bank Indonesia | Regulation on Digital Financial Innovation |

| Vietnam | State Bank of Vietnam | Pending Cryptocurrency Law |

onal financial authorities.”>

Investment Opportunities in a Regulated Environment

Investors and project developers benefit significantly from a clear regulatory framework. For instance, startups in Singapore have raised substantial funds due to the certainty of operating under established laws. In Vietnam, as

As we approach 2025, some potential investments that could blossom in this landscape include:

- Cryptocurrency exchanges compliant with local regulations.

- Blockchain solutions for supply chain management in various industries.

- Decentralized finance (DeFi) projects focusing on user safety and compliance.

The Importance of Legal Compliance

Compliance is not just a legal obligation; it’s also essential for building trust with customers. Here’s why:

ong>Investor Confidence: ong> Regulatory compliance enhances credibility, reassuring investors about the safety of their assets.ong>Avoiding Penalties: ong> Non-compliance can lead to hefty fines and trading suspensions, which can cripple businesses.ong>Market Integrity: ong> A transparent regulatory environment fosters fair competition, which is conducive to innovation.

Proactive Steps for Compliance

To navigate the complexities of

- Conduct regular audits of their operations.

- Engage with legal experts to stay updated on regulatory changes.

- Implement robust anti-money laundering (AML) and know your customer (KYC) processes.

Future Trends in Digital Asset Regulation

Looking ahead, several trends are likely to shape the regulatory landscape:

ong>Increased Collaboration: ong> Countries in the region may begin to collaborate on creating a unified regulatory framework.ong>Enhanced Consumer Protection Laws: ong> As the market matures, expect stricter consumer protection laws to be enacted.ong>Focus on Sustainability: ong> Regulations might shift towards ensuring sustainability in crypto mining and operations.

Preparing for the Future

The future of Southeast Asia digital asset regulations holds immense potential for innovation and growth. Stakeholders must stay informed and adaptable to thrive in a rapidly changing environment. Regular reviews of both local and international compliance standards will be crucial.

The Path Forward for Investors and Businesses

As an investor or a business operator in Southeast Asia, the onus is on you to keep abreast of regulatory changes. Actions you can take include:

- Subscribe to regulatory updates from local authorities.

- Join industry associations that offer insights and resources regarding compliance.

- Diversify your investment portfolio to mitigate risks associated with regulatory shifts.

Now more than ever, understanding the intricacies of digital asset regulations is not just beneficial — it is essential. As we move toward 2025, navigating the evolving landscape of regulations will be key to unlocking the true potential of the digital asset market in Southeast Asia.

In conclusion, clear and effective

For further insights on navigating the crypto space, visit globalcryptolearn.