Understanding HiBT Liquidity Pools for Cryptocurrency Growth

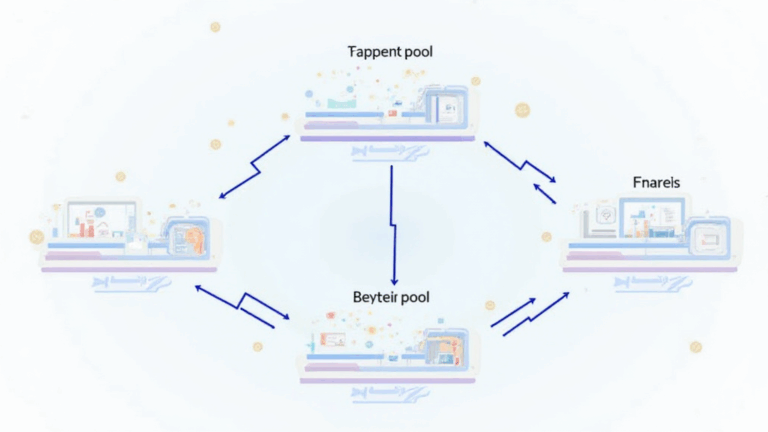

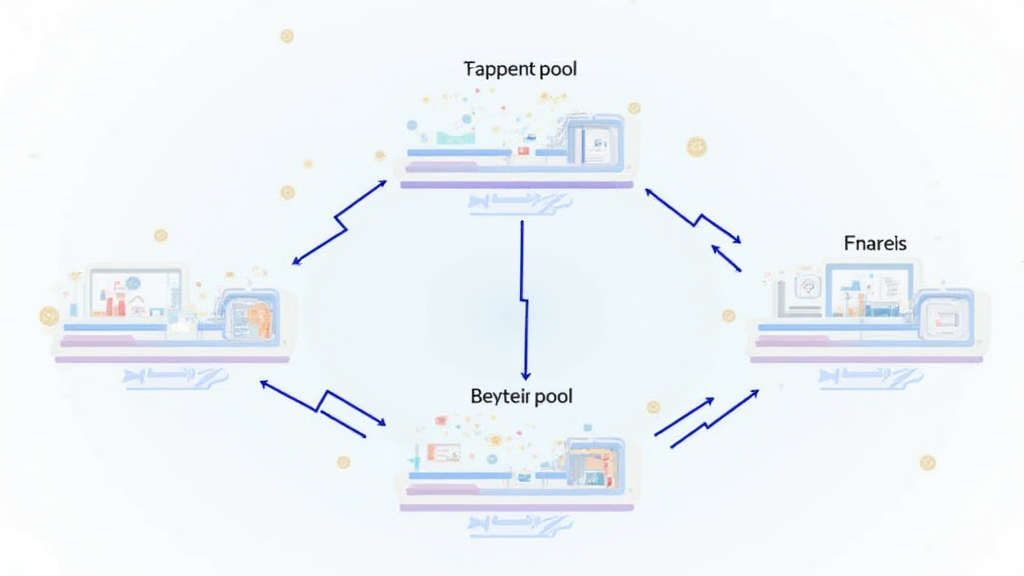

What are HiBT Liquidity Pools?

A HiBT liquidity pool is a collection of cryptocurrencies locked in a smart contract, facilitating trading on decentralized platforms without the need for traditional market makers. These pools allow users to trade assets directly from the contract, ensuring liquidity and efficiency. But you might be wondering, why should anyone care about liquidity pools?

ong>Liquidity Provision: ong> Users can deposit tokens into the HiBT liquidity pools, which the platform uses to facilitate trades between different cryptocurrencies.ong>Yield Farming: ong> Participants earn rewards in the form of fees generated by the trades happening within the pool.ong>Risk Mitigation: ong> Unlike traditional exchanges, liquidity pools enable trading without the risk of slippage, which means prices are more stable during large trades.

Why are HiBT Liquidity Pools Important?

They function like a bank vault for digital assets, providing both security and access. The importance of HiBT liquidity pools extends beyond their mechanics:

ong>Increased Market Depth: ong> By aggregating liquidity from various users, these pools enhance market depth, making it easier to execute large trades without impacting prices.ong>Decentralization: ong> They reduce reliance on centralized exchanges, promoting a more decentralized model of finance.ong>User Accessibility: ong> Anyone can participate by depositing cryptocurrencies, thus democratizing access to trading opportunities.

How to Utilize HiBT Liquidity Pools Effectively

Getting involved with HiBT liquidity pools can seem daunting, but here are some straightforward steps to help you dive in:

ong>Research and Choose a Pool: ong> Evaluate which HiBT liquidity pool aligns with your investment strategy by examining historical performance and token pairs.ong>Deposit Tokens: ong> Once chosen, deposit your tokens into the HiBT liquidity pool through the platform’s interface.ong>Monitor Your Investment: ong> Keep track of how your assets are performing, as well as the rewards generated from your liquidity provision.

Risk Factors in HiBT Liquidity Pools

Like any investment, participating in HiBT liquidity pools comes with risks:

ong>Impermanent Loss: ong> A potential loss arising from the volatility of token prices within the pool compared to holding them in your wallet.ong>Smart Contract Vulnerabilities: ong> As with any DeFi platform, bugs and vulnerabilities can occur, so ensure you choose audited smart contracts.ong>Market Liquidity Risk: ong> In times of market instability, liquidity can dry up, meaning your assets could become harder to sell.

The Vietnamese Market and HiBT Liquidity Pools

As we see a surge in crypto adoption in Vietnam, with a reported

ong>Safe Investments: ong> Due to a heightened awareness of security, liquidity pools that provide clear risk assessments will attract more Vietnamese users.ong>Yield Opportunities: ong> With many looking to leverage their investments, HiBT liquidity pools represent an enticing option.

Future Trends for HiBT Liquidity Pools

As we move forward, we can expect several trends to develop around HiBT liquidity pools:

ong>Integration with Traditional Finance: ong> The convergence of traditional financial systems with blockchain technology will push HiBT liquidity pools into new realms.ong>Enhanced Security Features: ong> Innovations in security will emerge, aiming to reduce risks associated with smart contracts.ong>Increased Regulation: ong> Governments are starting to blanket the DeFi landscape with regulations, which will call for trust and transparency in liquidity pools.

Conclusion: Embracing the Future with HiBT Liquidity Pools

HiBT liquidity pools are an essential part of the emerging landscape of decentralized finance. As we continue to see the market grow and evolve, understanding the fundamentals of these liquidity pools will become increasingly important for both new and experienced investors. Don’t miss out on the opportunity to secure your assets while potentially increasing your earnings through yield farming.

For more insights on cryptocurrency and decentralized finance, check out hibt.com.

Author: Dr. Alex Thompson

A blockchain security expert with over 15 published papers in fintech security and has led the audits for prominent DeFi protocols.