Introduction

In the rapidly evolving world of cryptocurrency, understanding

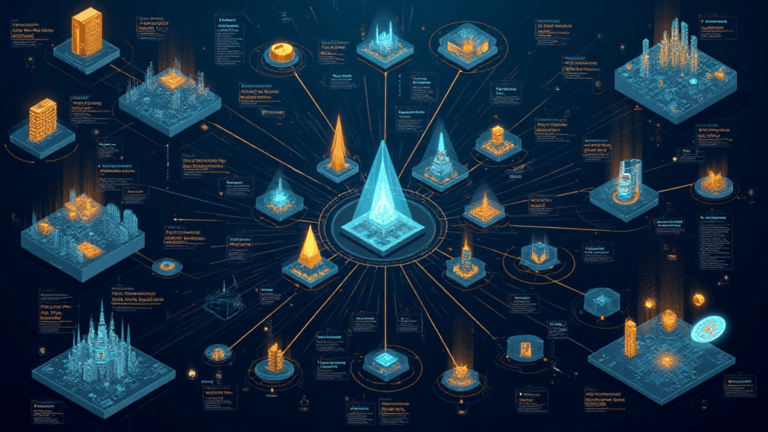

What Are Crypto Economic Models?

Crypto economic models are frameworks that govern the behavior of participants in blockchain ecosystems, influencing incentives, governance, and value distribution. These models are critical for maintaining the integrity and functionality of decentralized platforms.

ong>Incentive Structures: ong> These define how users are rewarded for participating in the network, whether through staking, governance voting, or liquidity provision.ong>Governance Mechanisms: ong> These models determine how decisions are made within the community, affecting everything from protocol upgrades to funding distributions.ong>Value Creation: ong> This explores how value is generated within a network, including mechanisms like transaction fees and mining rewards.

The Importance of Security in Crypto Economic Models

When we think about

- Evaluate consensus mechanisms for vulnerabilities.

- Implement rigorous auditing processes for smart contracts.

- Educate users about potential risks in various economic systems.

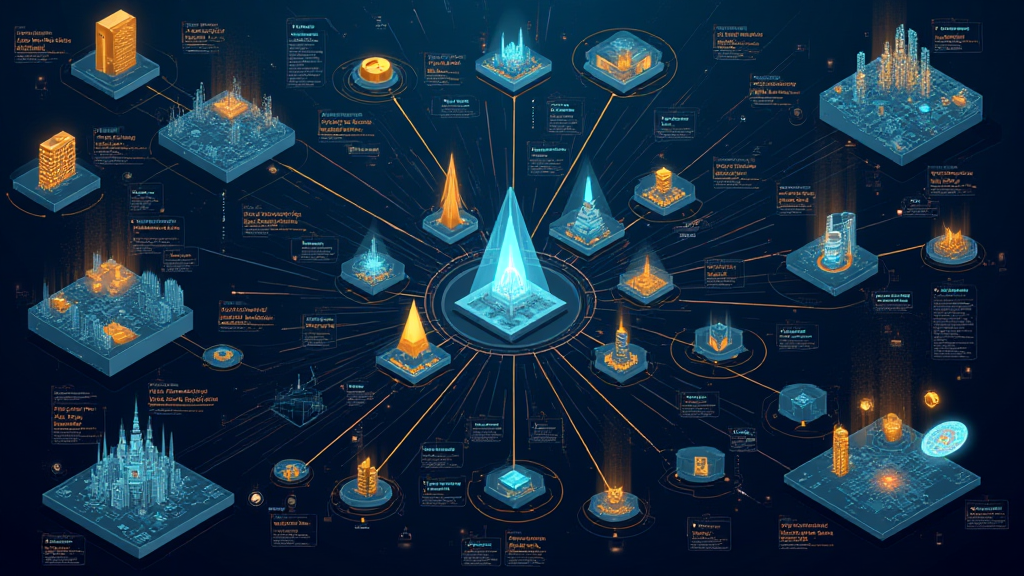

Consensus Mechanism Vulnerabilities

Consensus mechanisms are foundational to blockchain technology. They validate transactions and secure the network against fraud. However, they also possess vulnerabilities:

ong>Proof of Work (PoW): ong> Susceptible to 51% attacks, where an entity gains control of the majority of the network’s hash power.ong>Proof of Stake (PoS): ong> Vulnerable to long-range attacks, where attackers can create divergent histories.ong>Delegated Proof of Stake (DPoS): ong> Risks centralization as only a small group of delegates can validate transactions.

Applying Economic Models to Real-world Scenarios

Understanding crypto economic models is crucial for adapting to real-world applications. Let’s take a look at a couple of prominent examples:

ong>DeFi Protocols: ong> Platforms like Uniswap leverage automated market maker (AMM) models, allowing users to trade without traditional order books. They incentivize liquidity provision through token rewards.ong>Non-Fungible Tokens (NFTs): ong> Art and collectible marketplaces utilize unique economic models to create scarcity and drive demand, often hinged on community engagement and ownership rights.

The Vietnamese Market: A Growth Story

Vietnam is rapidly emerging as a significant player in the cryptocurrency landscape. In 2025, the user growth rate in Vietnam is projected to reach 32%, reflecting a growing interest in crypto investments, trading, and blockchain technology. As local regulations evolve, the application of strong crypto economic models will become critical to capitalize on this growth.

This shift provides a fertile ground for innovations in economic modeling that can cater specifically to the Vietnamese market, influencing user engagement and investment strategies.

The Future of Crypto Economic Models

As the world of cryptocurrency evolves, economic models will need to adapt to the following trends:

ong>Increased Regulation: ong> Adapting to compliance standards will redefine how economic models operate within jurisdictions, including measures like anti-money laundering (AML) protocols.ong>Enhanced User Education: ong> Educating users about different economic models will empower them to make informed decisions, potentially leading to more robust community-driven governance.ong>Integration with Traditional Finance: ong> Bridging the gap between traditional finance and crypto can enhance liquidity and stability, creating resilient economic models.

Conclusion

In conclusion, mastering

For more insights into this evolving field, visit globalcryptolearn, your resource for the latest updates and guides.