Introduction

In the rapidly evolving landscape of digital finance, the year 2024 has seen a staggering loss of $4.1 billion to DeFi hacks alone. Amidst this backdrop, understanding the nuances of

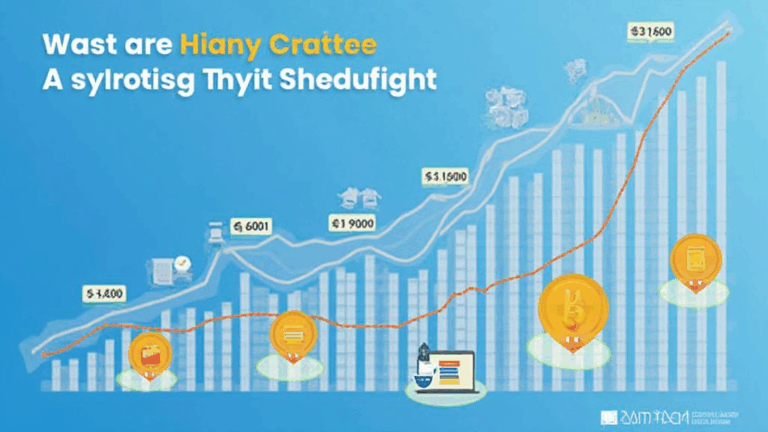

The Rise of Vietnam’s Crypto Lending Platforms

According to recent data, Vietnam’s cryptocurrency market experienced a remarkable user growth rate of 95% year-over-year. This growth underlines the demand for

ong>Peer-to-Peer Lending: ong> Unlike traditional banking, crypto lending platforms like Hibt offer peer-to-peer lending options that eliminate intermediaries, allowing users to engage directly.ong>Increased Accessibility: ong> With platforms catering to Vietnamese users, barriers to entry are lowered significantly.

Understanding the Mechanisms of Crypto Lending

Let’s break it down: crypto lending is akin to holding assets in a digital “vault.” Users deposit their cryptocurrencies, earning interest over time, while borrowers can access these funds with collateral.

Key mechanisms include:

ong>Collateralization: ong> Borrowers are required to put up collateral, typically more than they wish to borrow, mitigating default risks.ong>Interest Rates: ong> Rates can fluctuate based on demand and market conditions, creating potential for lucrative returns.

Key Players in Vietnam’s Crypto Lending Market

Several key players dominate the Vietnamese crypto lending scene:

ong>Myco: ong> Known for its user-friendly interface, Myco caters specifically to the Vietnamese demographic and offers competitive interest rates.ong>Coinlend: ong> Renowned for its security features, Coinlend focuses on ensuring user funds are protected.

Regulatory Landscape: Navigating Compliance

Regulations surrounding crypto lending in Vietnam remain fluid, with authorities looking to establish more rigid frameworks. Compliance is essential, and

ong>Consult Local Guidelines: ong> Ensure you are up-to-date with the latest regulations to avoid any legal repercussions.ong>Transparent Practices: ong> Choose platforms that prioritize transparency in their operations and user agreements.

Users’ Perspective: Risks and Rewards

For prospective users, understanding the risks involved is key. The balance between risk and reward in crypto lending is nuanced:

ong>Market Volatility: ong> Cryptocurrency prices can fluctuate wildly, impacting collateral values.ong>Platform Risks: ong> Choosing a reliable platform reduces exposure to hacks and systemic failures.

Future Outlook for Vietnam Crypto Lending Platforms

As the Vietnamese cryptocurrency market grows, so does the potential for lending platforms. Analysts predict a surge in investor interest, especially as more users become aware of potential gains in this sector.

Additionally, innovative products and improved security measures are likely to attract a wider audience. As mentioned, platforms adopting modern security protocols are expected to lower risks, thereby encouraging more users to participate in lending.

In conclusion, the future of

**Disclaimer: This article is not financial advice. Always consult local regulators before making investment decisions.**