Introduction

In 2024, the cryptocurrency market experienced a significant pivot, witnessing losses of approximately

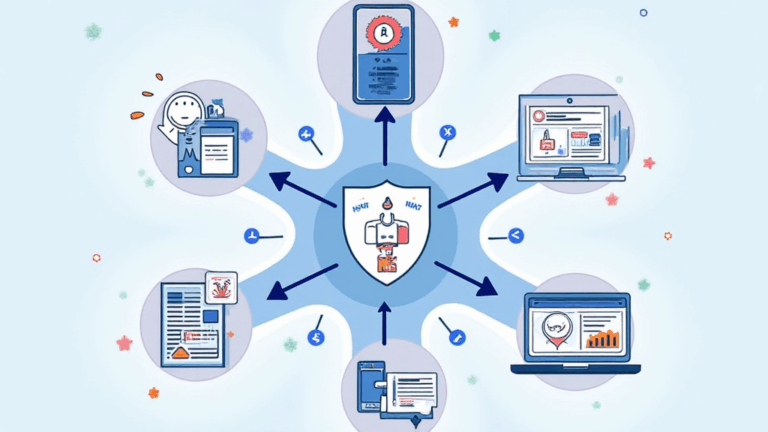

KYC, or Know Your Customer, is a vital process for financial institutions, especially in the blockchain ecosystem. HiBT’s KYC requirements aim to enhance security protocols for traders and investors. In this article, we will explore the intricacies of HiBT KYC, its necessity in the Vietnamese market, and provide insights into effectively managing risks associated with cryptocurrency.

Understanding HiBT and Its Role in Cryptocurrency

HiBT is a cutting-edge cryptocurrency trading platform offering extensive features tailored to both new and experienced users. With the soaring popularity of cryptocurrencies in markets like Vietnam—where user growth surged

KYC processes include verifying customer identities and assessing risks related to money laundering and terrorist financing. Incorporating these methods is crucial in building a trustworthy relationship with users.

The Specifics of HiBT KYC Requirements

When registering on HiBT, users must provide:

- Government-issued identification (passport, driver’s license)

- Proof of address (utility bill, bank statement)

- Selfie photo for identity verification

These measures are designed to protect users and legitimize the trading platform within the wider financial ecosystem, particularly in how it complies with regulations such as

The Importance of KYC in Cryptocurrency Trading

The lack of proper identity verification in cryptocurrency exchanges can lead to various risks, including:

- Fraudulent activities, such as identity theft

- Increased chances of money laundering

- Regulatory penalties for non-compliance

For instance, consider the 2022 incident where a prominent exchange faced severe backlash due to a substantial KYC oversight that facilitated illicit activities, eroding user confidence. HiBT’s KYC protocols aim to prevent such scenarios.

Applying HiBT’s KYC Requirements Effectively

To navigate the HiBT KYC requirements successfully, users should follow these tips:

ong>Prepare documentation in advance: ong> Gather all necessary documents, ensuring accuracy and validity.ong>Keep updated on regulations: ong> Stay informed on cryptocurrency regulations in your area, as laws can evolve rapidly.ong>Utilize secure networks: ong> Ensure that document submissions occur over secure, private networks to reduce data theft risks.

Compliance and Its Global Implications

According to the latest data from Chainalysis 2023, regulatory compliance is increasingly vital for cryptocurrency platforms. With global transaction volumes anticipated to reach

HiBT KYC Requirements and the Vietnamese Market

Vietnam has seen exponential growth in cryptocurrency adoption, with over

Compliance with local laws enhances the reliability of exchanges in Vietnam, where awareness of security practices remains vital. HiBT’s KYC approach fortifies user confidence, especially among Vietnamese investors keen on navigating the crypto world.

Real-World Application: A Case Study

In 2023, a Vietnamese trading platform faced scrutiny for its lax identity verification process. Following the implementation of stringent KYC processes that mirrored the HiBT model, the platform reported a

Conclusion

As we progress further into the crypto era, understanding HiBT KYC requirements becomes essential for secure trading. By implementing robust KYC measures, platforms like HiBT enhance user trust and promote compliance with regulatory standards. With virtually every interaction in the crypto space tied back to identity verification, it’s clear that contributing towards secure trading experiences in Vietnam and globally is paramount.

In conclusion, ensuring you meet HiBT KYC requirements not only protects your assets but also fosters a responsible trading environment conducive to growth in the cryptocurrency sector. For further guidance on navigating the complexities of the crypto space, visit HiBT.

Expert Opinion

Dr. Minh Nguyen, a recognized authority in blockchain technology and a frequent contributor to regulatory papers, holds a PhD in Financial Security. He has authored over