Understanding ETH Price Chart VND: Trends and Insights for Investors

With the rapid rise in popularity of cryptocurrencies in Vietnam, many investors are keenly interested in tracking the ETH price chart in VND. As Ethereum continues to be a dominant player in the digital asset market, understanding its price movements can help investors make informed decisions. In this article, we delve into the intricacies of the ETH price chart, market trends, and how these insights can shape investment strategies.

The Importance of Tracking ETH Price in VND

The ETH price chart VND is crucial for Vietnamese investors. As the cryptocurrency market evolves, knowing how Ethereum performs against the Vietnamese Dong (VND) enables investors to evaluate their positions effectively.

- According to local market analysts, the number of crypto users in Vietnam has increased by over 30% in the past year.

- This surge reflects a growing interest in digital assets, emphasizing the need for reliable price tracking.

Understanding Price Movements

Price movements in Ethereum can serve as indicators of market sentiment. When the ETH price rises, it may suggest optimism among traders, while a downward trend could indicate bearish sentiment. Like monitoring a stock’s performance, analyzing the ETH price chart provides valuable insights.

Key Factors Influencing ETH Price

Several factors contribute to the fluctuations in Ethereum’s price:

- Market Demand: An increase in the number of transactions on the Ethereum network typically drives up demand.

- Development Updates: News about upgrades or changes to the Ethereum protocol often influences investor confidence.

- Regulatory Environment: Regulatory news regarding cryptocurrencies can lead to sharp increases or decreases in price.

Comparative Analysis: ETH vs BTC

When considering the ETH price chart, it is also beneficial to compare Ethereum with Bitcoin (BTC). Historically, Bitcoin has been viewed as the ‘gold’ of cryptocurrency, while Ethereum is often labeled ‘silver’ due to its utility and application. In the Vietnamese market, understanding the ETH/BTC ratio can reveal insights into how Ethereum is performing relative to Bitcoin.

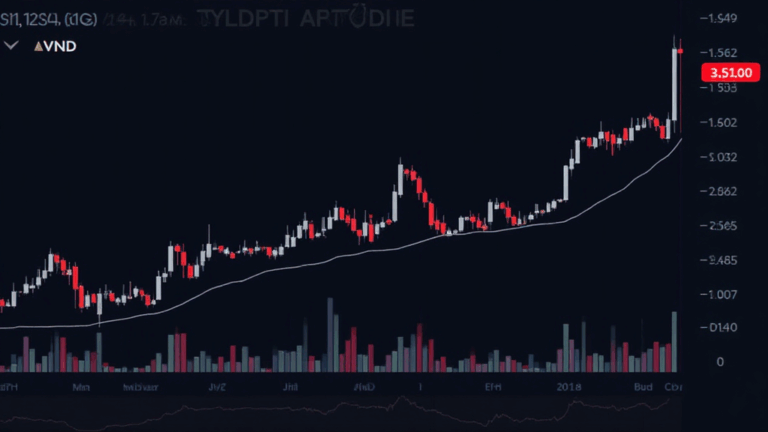

ETH Price Chart VND: How to Interpret It

When viewing the ETH price chart VND, investors should take note of specific patterns and trends:

- Support and Resistance Levels: Identify key price levels where ETH tends to bounce back (support) or face rejection (resistance).

- Volume Trends: Analyze trading volume alongside price movements. High volumes during price increases signal strong interest.

- Moving Averages: Using moving averages can help smooth out price data and identify longer-term trends.

The Role of Local Exchanges

In Vietnam, several exchanges facilitate the trading of Ethereum. These platforms often affect the local ETH price:

- Liquidity: Higher liquidity on exchanges can lead to more stable prices for ETH.

- Transaction Fees: Exchange fees can influence investment decisions and should be factored into the overall cost.

- User Experience: A straightforward user interface makes trading more accessible, potentially increasing engagement.

Future Trends: What to Expect for ETH

Looking ahead, the future of Ethereum and its price chart in VND seems promising. With ongoing developments such as Ethereum 2.0, which aims to improve scalability and sustainability, the positive trends may continue:

- Analysts predict that Ethereum prices could reach new highs as adoption increases.

- The integration of decentralization in finance (DeFi) is likely to propel further demand.

- Enhanced security features will likely build investor confidence and attract more participants.

Conclusion: Staying Informed in a Volatile Market

In conclusion, understanding the ETH price chart VND is crucial for any investor looking to navigate the cryptocurrency landscape. By monitoring price movements, recognizing market influences, and analyzing future trends, investors can make informed decisions.

It’s essential to stay updated on local market developments and global cryptocurrency news to appreciate fully the dynamics at play. With Vietnam’s growing digital asset landscape, the demand for clear, accurate price information will only increase. The key takeaway is to combine market knowledge with informed decision-making to enhance investment success.

If you’re keen to dive deeper into cryptocurrency trends, consider reading our related articles, such as 2025 Cryptocurrency Trends and How to Audit Smart Contracts.

Disclaimer: This article is not financial advice. Always consult with local financial regulators before making investment decisions.

By Dr. Nguyen Thanh Hai, a blockchain security expert and advisor with over 20 published papers in cryptocurrency analysis, and a lead auditor for multiple ICO projects.